triple bottom stock screener

Understanding Triple Bottom Chart Pattern. Select data to use select what to screen and click Screener button.

Related Technical Stock Screener.

. Ad Our Strong Buys Double the Sp. This is a stock market Screener for NSE. Triple bottom on BLNK.

Select data to use select what to screen and click Screener button. Bottom 100 Stocks to Buy. Schneider Electric currently have Smart Factories recognized as Advanced Manufacturing Lighthouses by The World Economic Forum.

Le Vaudreuil France From aging Brownfield plant to Smart Factory 5-15 overall equipment effectiveness improvement in 3-4 weeks on Contactor Line using EcoStruxure. If you just want to filter for triple bottom pattern stocks go to technical and under the pattern drop down select Multiple bottom. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts.

What a resistance we have at 26 yes this is a meme stock but we do like BLNK here technically. Trades often consider this as a strong support level and expected re-bounce from the triple bottom level. This is a stock market Screener for NSE.

The easiest screener to identify Triple bottom Patten is on Finviz. Based on Fundamental Analysis. The report shows you the symbols rank from the previous days report.

Weve achieved the following results. There are three equal lows followed by a break above resistance. The main reason so Crypto Triple Bottom Krypto Screener many fail at binaries is because they treat it like gambling.

DIXION is a very strong stock and has been in uptrend for a very long time. We are looking for a break and hold of that 26 level and in the short term will be taking profits at 27 28 29 and 30. Triple bottom chart pattern is formed when the sellers have faith that the stock price will go down further which leads to a new low bottom1 but fails to continue so due to the Support Basics results in a pull back.

Back to Traditional Patterns Stock Screener. The Top 100 Stocks page Ranks stocks by highest Weighted Alpha measure of how much a stock has changed in a one year period. How To Use Triple Bottom Screener.

All Patterns Screener Learn Triple Bottom. A rank of NA indicates that the symbol is new to todays report it was not on the Top 100 page yesterday. Take a look at BLNK.

The share market Screener of NSE will analyse the selected data for all listed stocks of NSE to find the sstocks that are forming. Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. These patterns are essential to.

The view below shows two results as of this writing that meets all this criteria 3 descriptive I have selected. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Support By Daily Trendline.

Stock has shown strong support on weekly and daily chart also has made triple bottom on daily chart can go long with previous low shock should bounce also seen increase in volume Disclaimer The information and publications are not meant to be and do not constitute financial investment trading or other types of advice or. NSE Daily chart Screener. As major reversal patterns these patterns usually form over a 3- to 6-month period.

In the past it has broken the strong resistance 4800 and is now a support of the breakout same might happen if the triple bottom bounces back to resistance 5529 and give a breakout to create a new support. Triple BottomPattern Screener for Indian Stocks from 5 Mins to Monthly Ticks. Again the sellers tries to reduce the price but fails to get enough momentum to further decrease the price which results.

Stocks hitting triple bottom in daily candle with increasing volume and cost Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. The Candlestick pattern shows the 3 major support levels of a stock from where it previously managed to give a bouce. 2 rows Screener - Triple Bottom Chart Patterns on Daily Tick in Short Term.

Overview Charts Fundamental. Good to buy at support. Triple Top Triple Bottom Formed By Hotel Leela Venture Ltd - Example 2.

Refer chart for details Accumulation is over triple bottom aggressive entry Disclaimer The information and publications are not meant to be and do not constitute financial investment trading or other types of advice or recommendations supplied or endorsed by TradingView. They go all in or get in when there signal hasnt told them to yet. PNFatr1214 Triple Bottom Back to Point Figure Stock Screener Overview Charts Fundamental Technical Price Performance Financial Ratios Relative Strength Financial Strength Dividend Timestamp Membership Details.

Till then we have to wait and watch. Medium Term Long Term Futures. Powerful EOD Pattern and TrendLine Screener helps you to screen for classical technical reversal patterns such as Head Shoulders Pattern Inverted Head Shoulders Pattern Double Top Pattern Double Bottom Pattern Triple Top Pattern and Triple Bottom Pattern Bullish and Bearish TrendLines Triangle Chart Patterns in seconds.

Crypto Triple Bottom Krypto Screener have to have is a decent strategy and stick to your rules.

Stock Chart Patterns Today We Are Going To Teach You How To By Collabtrade Medium

Screener Triple Bottom Chart Patterns On Daily Tick In Short Term

Triple Bottom Reversal Chartschool

Triple Bottom Stock Pattern Easy To Understand Guide

Tutorials On Triple Bottom Chart Pattern

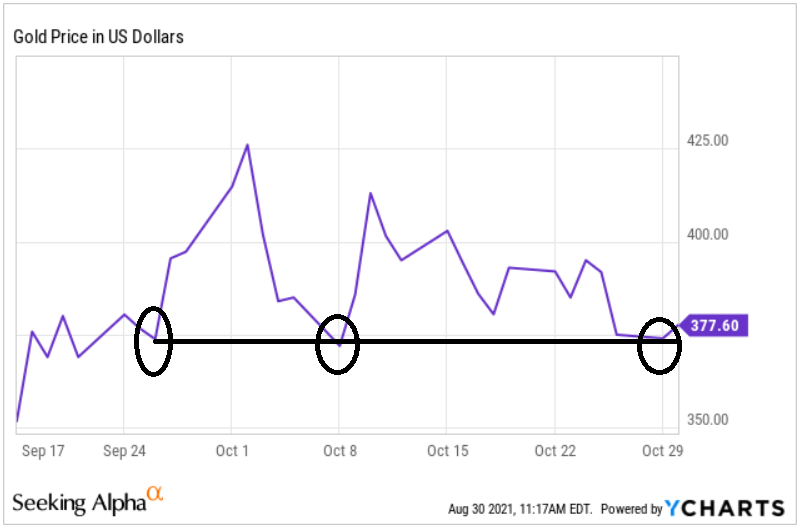

A Short History Of Triple Bottoms In Gold Seeking Alpha

Screener Triple Bottom Chart Patterns On Daily Tick In Short Term

Triple Bottom Stock Pattern Easy To Understand Guide

Chart Pattern Screener Triple Bottom From 5 Mins To Monthly Ticks